Your credit information report plays a major part in your loan application process. And also remember that you cannot improve your report overnight. A bad credit history decreases your chances of getting loans. Before we go into the details, here are some facts you should know: –

- A credit repair company cannot remove or change any information in your CIBIL report directly.

- A Credit Repair Company will usually ensure confidentiality of your CIR.

- You can always opt for CIBIL’s online resolution process free of charge.

- Only the respective bank or financial institution can make changes in your credit report, credit repair companies facilitate this process.

There are two major reasons why your CIR can be bad.

-

Inaccurate information

-

And defaults in payments

For 1, In case the information is incorrect, then you can initiate the resolution with us. And if your bank confirms that the information is right then CIBIL cannot do anything. It is always better to first get in touch with your respective bank to correct any information.

For 2, if you have many unpaid or late repayments of debts and EMIs and credit card bills then it is entirely your fault. In case you faced financial crisis which caused you not to repay fullyin the past, then make it a point to repay your pending dues once your finances are stable.

If you have relocated and your credit card bills are reaching the previous address and you aren’t aware of it, there is a chance you might miss paying by the due date. In that case, always keep email and text options open for your banks. Everything happens on the phone these days, so it is good on your part to have alerts coming to your email address and mobile numbers. In this way, you can at least be in sync with all your repayments of credit cards.

Terms and conditions are something a lot of us ignore. But before taking a loan or credit card, read carefully. They don’t just write terms and conditions for formality. It is important to go through them once before you confirm. You may need a magnifying glass to read the fine print though, but make an attempt to do so as you will realise the importance of these clauses only when you feel you are being overcharged.

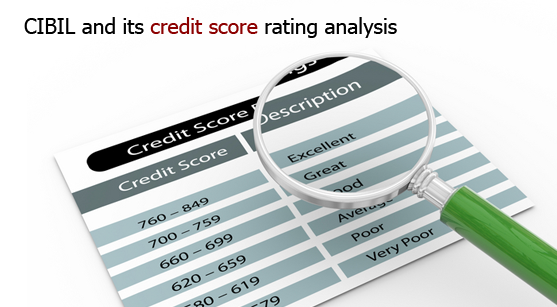

In case you have missed payments because you forgot them or thought it was fine to delay by one or two weeks, then you are at major loss. Paying your lenders on time is important for your credit score to remain healthy and to get your loan application sanctioned. When people opt for home loans, a credit score of 600 score is considered poor. So, if you need a large loan, you will not be able to obtain it due to your carelessness of maintaining a poor financial credit history.

These are the two major issues that can spoil your CIR. But thanks to the credit score repair companies who come to our rescue. But if you are not careful about your credit account repayment history, then they cannot help you in that!