Applying for and getting a credit card is considered quite easy now-a-days. You may have heard many of your friends and acquaintances getting several calls and online offers for credit cards with attractive reward points and cash back benefits. You may have got a few of them yourself. But did you know that credit cards are not only helpful to spend when you don’t have ready cash or a balance in your salary or savings accounts, but they also help in growth of your CIBIL credit score?

How does one qualify for a card?

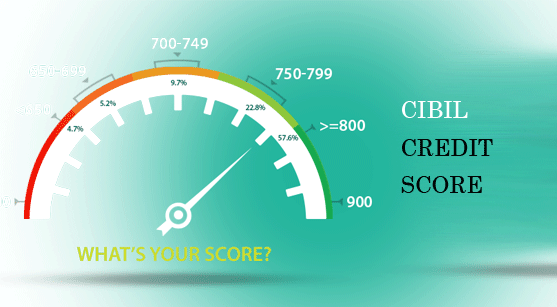

Just because you have got an offer (some like to call if a pre-approved credit card), it does not mean you will certainly get the card when you apply for it. Just like any other credit such as vehicle or education loans, you must submit an application and provide adequate documentary evidence such as your ID and address proofs and your employment details. The three main criteria lending institutions look for are, firstly, your ability to repay the requested debt (IT returns or Form-16), secondly, what is the value of the collateral (say, a fixed deposit) you are offering for this instance of debt, and thirdly, the most important criterion today for banks is your willingness to repay – that is verified by analysing your credit history and your 3-digit credit score. When your credit score and other loan eligibility documents are all satisfactory, you get a credit card approval. The credit limit and card terms also largely depend on your credit history. CIBIL credit scores can range anywhere between 300 and 900, scores above 750 being preferred by 80% of banks today.

How does a card help your credit?

Coming to the main topic, let us see how a credit card can help you with your scores:

-

Provided you make your monthly payments for your cards on time, whether it is the minimum payment or the whole balance, your credit score will improve.

-

If you keep the outstanding balance of all your credit cards less than 30% of the combined credit limit, banks consider this to be an excellent balancing of debts and incomes and this also improves your credit score.

-

If you have credit card accounts which have been active for a long time and on which you have been making regular, timely payments, do not cancel such accounts. These contribute to a large extent in keeping your scores high.

-

Before you apply for a credit card, think if it is really necessary. If you already have 2-3 cards, it is not advisable you apply for another credit card. If you have too many such cards, banks may consider you to be a slightly higher risk than usual and will deny you a loan in future. So to get a card which you don’t really need, you are giving up your chances to qualify for a much more important loan when the need for it actually arises.

-

Provided you monitor your credit scores and credit report regularly, you will know exactly what the status of your credit cards and their balance are in terms of improving or deteriorating your credit score. If you find any information about your card that has not been updated correctly by your bank, you should approach the bank and CIBIL to get this rectified immediately.

Using your credit scores wisely is a very wise move for your month-to-month finances as well as your long-term credit reputation. So start handling your credit cards with care today!

Tagged: credit rating agencies, credit rating company in india, credit rating report

Leave a comment