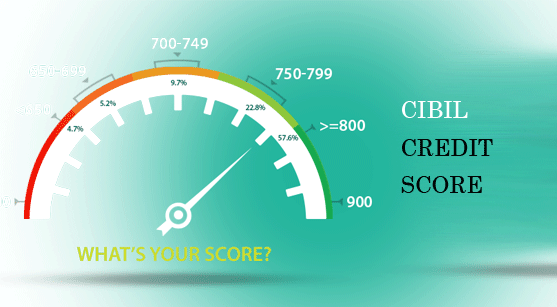

Financial security is extremely important to people in all industries and from all walks of life. This means security is not only for the present, or in terms of business, where the current assets match the current liabilities in a 1:1 ratio, but it also implies that the future is secured for you, your family and your organization. Credit score analysis is being used increasingly by more and more institutions to judge if a person is worth the risk of extending a loan or credit card too. It is nearly impossible for anyone to have financial security without having a good, if not impeccable credit history.

Let’s look at some facts and figures.

-

It is interesting to note that there is a very clear relationship between the age and scores of people in India. Senior citizens are said to be the most secure in terms of scores whereas people in the age group of 25-35 are said to be the riskiest. These figures are collected not just from people in India, but also from many other nations where the credit scoring system is highly prevalent.

-

Financial security also largely depends on the industry or work domain you belong to. Statistics show that while people belonging to the real estate and IT industry have people with some of the most stable credit scores, people engaged in manual labour tend to have lower scores. This point doesn’t have any intention to degrade any profession but is just a statistic. You could have a credit score of 850 even if you work as a truck driver provided you maintain your loans and credit card payments well and at the same time, a software engineer who spends more than he earns could have score in the low 500s.

-

There is a definite upswing in the employment records of the country. In the year 2010, the unemployment rate was about 9.4%, but in the year 2014, it dropped to about 4.9%. Another point to be noted in this section is that the unemployment rate amongst the youth has dropped from 18.10% to 12.90%. This means the younger generation has more available money to save and spend.

Coming to the crux of this page, based on the above details, we can clearly make out that more and more people are becoming financially secure, even after they retire. So does one really have to worry about credit scores so much? The answer is – you should always stay on top of the credit game, no matter what your age and employment situation is. Here are some of the scenarios which may lead to fluctuations in your disposable income, thus affecting your credit score directly

-

Your company may stop increasing your salary.

-

The inflation rate of India varies from time to time but your income is not always that flexible.

-

As time passes, your productivity and enthusiasm to work may also decrease.

-

Many industries have cycles of ups and downs and you never know when it might be your industry’s turn.

Credit score repair agencies and your own efforts may help repair most of the damages, but it is advisable to always have good credit scores by having a strong financial credit history so you can avoid being victims of such circumstances in the first place.